On October 26, Beijing Junzheng, the leading domestic vehicle storage company, released its third quarter report for 2021. The profit in the third quarter increased by nearly 25 times year-on-year to 280 million yuan.

Earnings grew rapidly in the third quarter

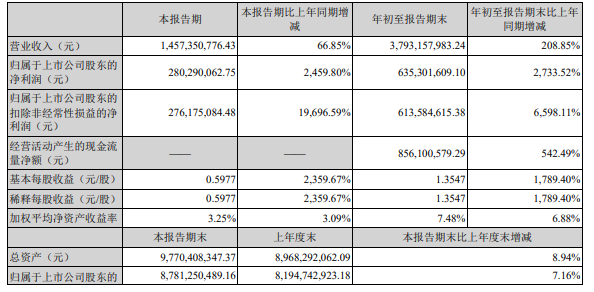

According to the report, in the third quarter, Beijing Junzheng achieved operating income of 1.457 billion yuan, a year-on-year increase of 66.85%; net profit attributable to shareholders of listed companies was about 280 million yuan, a year-on-year increase of 2459.80%.

In the first three quarters, Beijing Junzheng achieved an operating income of about 3.793 billion yuan, a year-on-year increase of 208.85%; the net profit attributable to shareholders of the listed company was 635 million yuan, a year-on-year increase of 2733.52%.

Image source: Screenshot of Beijing Junzheng Announcement

Beijing Junzheng believes that the main reason for the change in performance is that during the reporting period, the market demand for each product line was strong, which caused the company’s operating income to maintain growth. At the same time, Beijing Sicheng semiconductor Co., Ltd. (hereinafter referred to as “Beijing Sicheng”) has been included in the scope of consolidation since May 31, 2020, resulting in significant year-on-year changes.

According to the official website, Beijing Jun is an integrated circuit design company, mainly engaged in multimedia encoding and decoding technology, image signal processing technology, AI engine technology, AI algorithm technology and other fields.

In May 2020, Beijing Junzheng completed the acquisition of Beijing Sicheng (formerly ISSI) and its sub-brand Lumissil. Through the acquisition of Beijing Sicheng, Beijing Junzheng has a complete memory product line and analog product line. Its products have expanded chip products such as SRAM, DRAM, FLASH, Analog and Connectivity. The products are widely used in automotive electronics, industrial and Medical, communication equipment and consumer electronics and other fields. Beijing Junzheng has also gradually developed into a leading enterprise in China’s automotive storage IC.

Official information shows that Beijing Sicheng is a supplier of integrated circuit memory and related devices. The company’s main products are mainly volatile memory chips such as DRAM and SRAM, and it is also engaged in export business. According to media reports, since the beginning of this year, domestic chips have been paid more and more attention by the domestic automobile industry, and Beijing Sicheng, as a domestic company, will have better advantages in product promotion.

Strengthen the deep binding with the upstream supply chain

According to reports, the shortage of chips in the chip industry in 2021 does not seem to show signs of abating. All kinds of chips are tight and difficult to order, and the expansion plan this year has also shrunk significantly. In the tide of wafer shortages, Beijing Junzheng’s strategy is to deploy in the foundry field and strengthen the deep binding with the upstream supply chain.

On July 16 this year, Beijing Junzheng announced that the company plans to cooperate with professional capital and industrial resources to use its own funds of 100 million yuan to subscribe for the share of Shanghai Wuyue Fengpujiang Phase II Equity Investment Partnership (Limited Partnership), and to integrate the investment layout. industries in circuit design and artificial intelligence.

On July 30, a reply letter disclosed by Beijing Junzheng showed that the company intends to invest in Rongxin Semiconductor, which is mainly engaged in the upstream industry chain business such as wafer foundry, in order to further strengthen the deep binding with the upstream supply chain in the future. .

Soon after, Beijing Junzheng announced that the company plans to raise 1.3 billion yuan to invest in the R&D and industrialization projects of embedded MPU chips, the R&D and industrialization projects of smart video series chips, and the R&D and industrialization of automotive LED lighting series chips. Projects, R&D and industrialization projects of automotive ISP series chips and supplementary working capital. This item was approved by the China Securities Regulatory Commission on September 24.

While Beijing Jun is investing abroad, it also receives investment from other companies.

On October 22, Weir shares announced that the company’s wholly-owned enterprise, Shaoxing Weihao Enterprise Management Consulting Partnership (Limited Partnership), intends to participate in the subscription of Beijing Junzheng’s stock issuance to specific objects with its own funds of RMB 550 million.

The total amount of funds raised by Beijing Junzheng to issue stocks to specific objects this time does not exceed 1.307 billion yuan, and the net amount of funds raised after deducting issuance expenses will be used for the above-mentioned industrial research and development projects such as embedded MPU chips.

Weil shares said that the company, as a global leader in automotive CIS, will deepen cooperation with Beijing Junzheng in the automotive electronics market to achieve complementary resources in customer product solutions and future technical directions. The planned addition of Beijing Junzheng is conducive to further strengthening business strategic cooperation and realizing positive effects such as resource complementarity and development strategy synergy.

Although the wafer production capacity is tight, the trend of rapid growth in the third quarter of this year also shows that Beijing Junzheng is still moving forward.